8th CPC Salary Calculator – General Financial Rules GFR-2017: If you’re a central government employee or retiree, you’ve probably been waiting for some real clarity on the 8th Pay Commission. And honestly, the way people have been talking about it—WhatsApp forwards, office rumours, half-baked YouTube “updates”—it’s no wonder many are confused.

Here’s the thing most people don’t realize: the 8th Pay Commission isn’t just a routine revision. It’s a complete reset of how salaries and pensions will keep pace with living costs over the next decade. And with the government officially approving the commission on 16 January 2025, the wheels are already turning.

What Exactly Has Been Approved?

The Union Cabinet has given the green signal to set up the 8th Pay Commission with an implementation date locked in for 1 January 2026. Its job?

To redesign pay, pensions, and welfare benefits so they reflect today’s economic realities—not the world of 10 years ago.

From everything we know so far, the commission is focusing heavily on:

- Fair compensation

- Better retirement security

- Sustainable pay increase frameworks

- Inflation-linked revision cycles

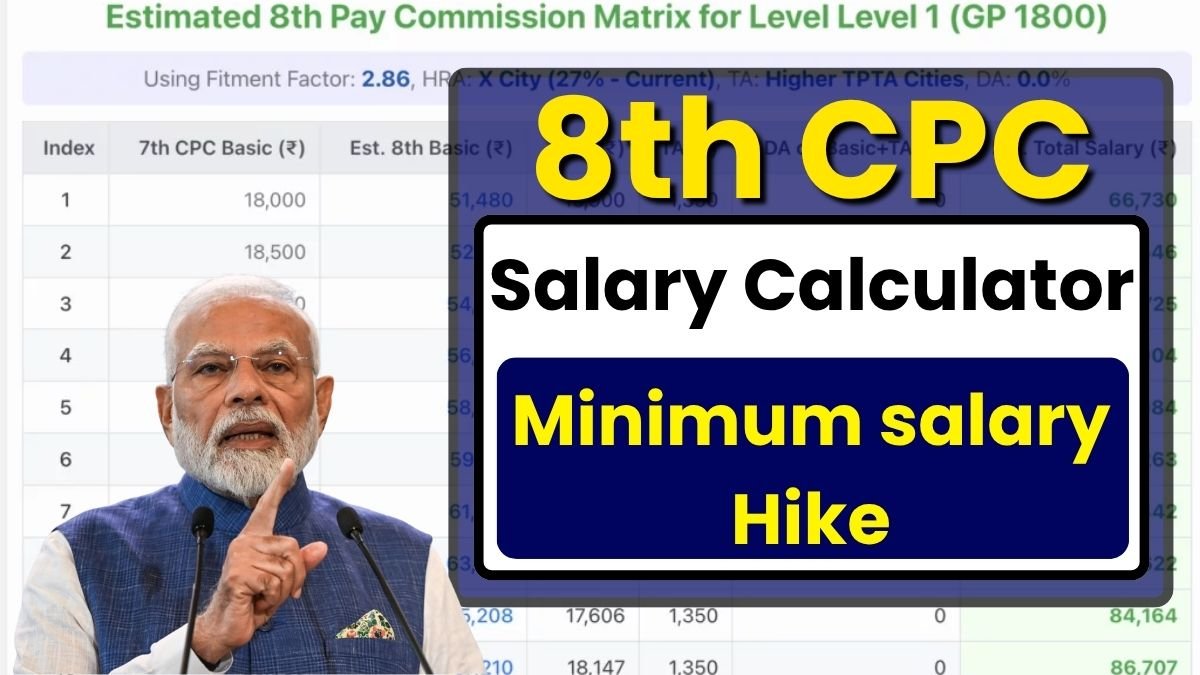

The Fitment Factor Everyone Is Talking About

Let’s break it down without the jargon.

The proposed Fitment Factor of 2.28 means your basic pay under the 7th CPC will multiply by 2.28 to calculate your revised pay.

That alone increases the minimum wage from ₹18,000 to nearly ₹41,000, a jump of 34.1%.

And that’s not all. By January 2026, the Dearness Allowance (DA) is expected to hit 70%. Instead of continuing as a separate component, this DA will merge into the basic salary—which is good news for overall increments and pension calculations.

Who Stands to Benefit?

Roughly 48.62 lakh employees and 67.85 lakh pensioners.

That’s practically every family connected to central government service.

The expected salary revision range—₹20,000 to ₹25,000—isn’t imaginative guesswork; it aligns closely with the revised pay structure and projected allowances.

8th Pay Commission Overview

- Authority: DoPT

- Fitment Factor: 2.28 (expected)

- DA Expectation: 70% by 2026

- Minimum Wage: ₹41,000 (expected)

- Beneficiaries: CG employees + pensioners

- Implementation: 1 January 2026

How to Estimate Your New Salary (Simple Breakdown)

You’ve probably seen complicated salary calculators floating around. Forget those. Here’s a straightforward way to understand your future pay under the 8th Pay Commission.

Step 1:

Take your current 7th CPC basic pay.

Step 2:

Multiply it by the fitment factor (example used below: 3.0 for illustration).

Revised Basic = Current Basic × 3.0

Step 3:

Add DA (assuming 50%).

DA = Revised Basic × 0.50

Step 4:

Add HRA based on your city:

- Metro: 27%

- Tier-2: 20%

- Tier-3: 10%

Step 5:

Include Travel Allowance (TA).

Step 6:

Add everything and subtract the standard deduction.

That’s your estimated gross salary.

This isn’t the official calculator—but it gives you a realistic sense of what you might take home in 2026.

Frequently Asked Questions

1. When will the 8th Pay Commission actually be implemented?

The government has confirmed that the new pay structure will take effect from 1 January 2026. Salary and pension revisions will follow after the official report is submitted.

2. Will pensions increase under the 8th Pay Commission?

Yes. Pensioners will benefit from the higher basic pay (after DA merger) and an improved minimum pension structure. Payments will also be disbursed faster under the updated system.

3. What will be the minimum salary under the 8th Pay Commission?

Based on the proposed fitment factor, the minimum salary is expected to rise from ₹18,000 to around ₹41,000.